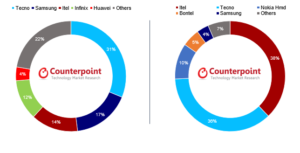

The market share of Tecno, a Transsion Group brand, reached the highest ever level of 31% during Q1 2019 in the Nigerian smartphone market, according to the latest research from Counterpoint’s Market Pulse Service. Tecno’s popularity was due to the launch of new models and the release of promotional offers to attract young buyers.

Commenting on the Tecno’s performance, Anshika Jain, Research Analyst at Counterpoint Research said, “Tecno’s impressive performance was due to its focus on bringing affordable devices in the Nigerian market which targetted the youth. The brand has deepened its market presence by upgrading its Camon Series, launching an Android Go device (Pop 2) for the low-end users, and introducing various gift offers with special schemes rolled out during the Valentine’s Day week. Tecno’s performance in Q1 2019 also helped Transsion Group (Tecno, itel, and Infinix) reach its highest ever market share in the Nigerian smartphone market at 56%.”

During Q1 2019, itel had an 18% year-on-year (YoY) growth in smartphone shipments driven by new launches like A33 and A33 Plus as well as the strong performance of earlier models like the A32F, A16 and A1of earlier models like the A32F, A16, and A14. Meanwhile, Infinix’s market share remained flat YoY in Q1 2019 even though its Hot 6 and Hot 6 Pro models were among the top 10 best-selling devices. Not only was Transsion Group, the clear leader in the smartphone market, but it also dominated the feature phone market with Tecno and itel capturing a 74% share.

Overall, smartphone sales in Nigeria during Q1 2019 fell 16% quarter-on-quarter (QoQ) as most of the smartphone brands and outlets focused on clearing out existing stocks during Q1 2019.

Commenting on the overall market, Jain said, “We expect the smartphone market to grow in the coming quarters as new players are entering into the market. In Q1 2019 specifically, we have seen brands from China and other countries increasing their presence, reflecting the potential of this market. For instance, OPPO launched the F Series, Xiaomi launched the Redmi Note 7 series while Lava made a debut through the launch of its Z series and the Iris 51 smartphones. The declining market share of local players and exit of some of the long tail brands will provide a good opportunity for new players to gain prominence. We expect to see increased competition after the entry of Xiaomi, OPPO, and Lava, which could benefit the price-sensitive customers.”

Already Chinese brands control more than two-thirds of the Nigerian smartphone market. This is mainly due to their value for money offerings, focus on product quality, and consistent launch of new devices in the budget segment.

Looking at the major findings, Tarun Pathak, Associate Director at Counterpoint Research, said, “Low and mid-priced phones still rule the market. However, features like camera quality and 4G availability are the major factors which will drive further smartphone penetration in the country. Network providers are also at the forefront of driving smartphone adoption by offering various purchase options to their customers, including financing and other incentives.”

Market Summary:

- The top five brands captured a record 77% share of the market.

- Samsung remained the second largest smartphone brand, with a 17% share. Its share in terms of value has grown as the Korean brand began this year with the launch of its flagship devices, the S10 series.

- Nokia was the fastest growing brand driven by the Nokia 1, 6.1 Plus and its newly launched flagship model Nokia 8.1.

- Huawei grew 4% YoY due to its popular devices Honor 7S, Y9, and Honor 7A. Huawei is slowly increasing its presence in the Nigerian market with numerous activities in Q1 2019. However, the brand is yet to gain broad acceptance due to its relatively higher costs.

- US$50-US$99 segment was the biggest in terms of volume (42.8%), which shows Nigeria is still a price sensitive market. Chinese brands dominate this segment.

- Samsung and Apple largely drive the premium market with their Samsung S10 series and Apple XS and XR models.

- The feature phone segment declined marginally by 1% sequentially in Q1 2019.